I can’t tell you how many times I had this conversation with founders this week about staying focused and lean and mean, until getting to product market fit. Thanks to Jevon who we’ve backed twice before with GoInstant (sold to Salesforce) and Manifold (sold to Snyk) to share some hard earned wisdom.

With so much cash flowing during the last 24 months, it was easy to hire too fast but many don’t realize the coordination and management overhead associated with having too many people. Onboarding new folks, getting them up to speed on the codebase, and managing internal communications issues all defocus founders from the real goal - to get users and orgs to use their product and rely on their product.

I’ll give you another example. While it absolutely sucks to have to let go of amazing employees that you hired, one founder told me he couldn’t believe the velocity and energy from the development team once it shrank 50% from a core team of 12 to 6 of the best. In fact, what I will argue is that the labor market was so tight during the last 24 months that many companies did not end up hiring the best of the best and now that many cos are not hiring any more, some amazing talent will come available.

While I don’t have a 🔮, all I can say we have more pain coming ahead in the next few quarters. The only products getting real attention and usage are ones that have incredible time to value so if you don’t have that, figure out how to build something that does. Ask yourself what everyone is doing to help you get to one goal, product market fit or IMO, 10 referencenable orgs which are users/teams/orgs that meet your criteria for active usage, show expansion of usage over time, and would say they can’t live without your product. Some can be paying or not but all should be huge advocates of your product.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Pure gold

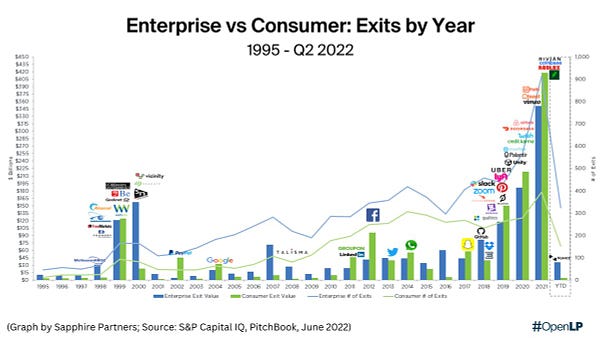

Enterprise vs. Consumer when it comes to driving exit value?

Great historical market data on enterprise growth, multiples, and more

Enterprise Tech

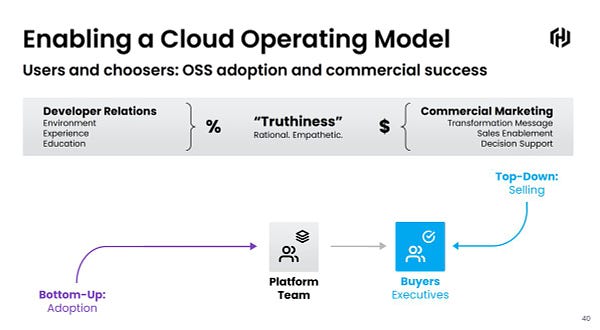

Yes, PLG or bottoms up or developer first still means you will eventually need an enterprise motion but it’s a question of when to sequence - Hashicorp lays out its journey nicely for its public investors 🧵

👇🏼

Read how one of the master of developer first PLG helped @auth0 get unstuck on its way from $40M to $80M of ARR1\ Years ago @auth0 stopped growing in pipeline, talk to sales, and signups. we had to change what the marketing team was doing for 6 months to get us back on track. It was a hard decision to make but tough times (like now) require bold decisions. Read the story 👇

Read how one of the master of developer first PLG helped @auth0 get unstuck on its way from $40M to $80M of ARR1\ Years ago @auth0 stopped growing in pipeline, talk to sales, and signups. we had to change what the marketing team was doing for 6 months to get us back on track. It was a hard decision to make but tough times (like now) require bold decisions. Read the story 👇 Gonto 🤓 @mgonto

Gonto 🤓 @mgontoFantastic read from Patrick Chase on how some of the best OSS companies got their first 1k community members (h/t ShomikGhosh21) - Hashicorp, Confluent, Databricks, and CockroachDB.

How did you get your first 1000 community members?

How long did it take you to grow your community to 1000 people?

What was your north star metric for your open source community?

What did success look like for that metric?

Microsoft broadens shift ⬅️ security offerings

More on generative AI - impressive

Must read for those investing in dev tooling and ops from Charity Majors, Honeycomb - this was written as Honeycomb has been searching for who the target user and customer is - difficult when founders start companies ahead of a trend but now it seems like Honeycomb has found its target - platform engineering teams

I've spent a lot of time thinking about this because we've had such a hard time nailing down exactly who the Honeycomb customer is. Sometimes our buyer is an ops team buying it for their SWEs, sometimes it's SREs in the midst of an outage, sometimes it's a VP or director of engineering, or an architect, or a CTO, or a "full stack" engineering team, or even a product manager. It is hard to form a snappy answer out of that list.

The first couple questions every new go-to-market candidate asks us are "who is your buyer?" and “how do we help them?” To which I respond with a five minute ramble where I list every above persona and each of their pain points. Hardly the concrete answer they would like to receive.

As it goes, sociotechnical trends come and go. A year ago, Christine and I were speculating that platform engineering might be on the verge of consolidating the necessary ingredients that makes up our ideal buyer:

Writing and shipping code, and needing to understand their own code

Positioned to help other teams with their instrumentation patterns and tooling

Firmly cloud-native+ and untethered to hardware or traditional infrastructure

To my delight, since that conversation, these trends have only accelerated—and I, for one, welcome our new platform engineering overlords to the observability table.

This is huge - TradFi still building businesses around crypto

Talk about enterprises moving to the ☁️ - this announcement from Google Next ‘22 is 🔥 - 9 out of 10 banks still use mainframes. Google Cloud wants to reduce that (Protocol)

The new Dual Run service allows for parallel processing on premises and on the Google Cloud Platform to ensure workloads are performing satisfactorily before fully transitioning to the cloud.

“At the core of our design philosophy, we think 'workload in,' so that everything we design is optimized for performance, security, manageability of those workloads,” Nirav Mehta, Google Cloud’s senior director of product management for cloud infrastructure solutions and growth, said in an interview with Protocol.

In the quest for VC and Investor TAM, what can go wrong 🧵

(1/12) Every software company wants to go from single point solution to multi-product suite Survivor bias blinds companies + investors to the execution risk. They pencil our crazy expectations Don't be blinded by the TAM. Here's how Act 2 can derail, and even kill, a business

(1/12) Every software company wants to go from single point solution to multi-product suite Survivor bias blinds companies + investors to the execution risk. They pencil our crazy expectations Don't be blinded by the TAM. Here's how Act 2 can derail, and even kill, a business @ExitMultiple @buccocapital Agreed most of time but startups need to start w/doing one thing amazingly well. The trap is when they try to go whole product solution or platform out of gate in search of TAM - that is sure death. + yes many of tiny PLGs will not make it but ones that do need to start narrow

@ExitMultiple @buccocapital Agreed most of time but startups need to start w/doing one thing amazingly well. The trap is when they try to go whole product solution or platform out of gate in search of TAM - that is sure death. + yes many of tiny PLGs will not make it but ones that do need to start narrow

Markets

Sign of the times from WSJ…Venture-Capital Firms Buy Up Public Tech Stocks as Startup Market Stalls - Startup investors, known for making risky bets on unproven companies, are taking advantage of lower share prices following a market rout

Jamie Dimon from JP Morgan shares whats ahead in next few quarters and its not pretty

‘This is serious’: JPMorgan’s Jamie Dimon warns U.S. likely to tip into recession in 6 to 9 months

🤔

As always, on point. Great read!