Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #212

Why founders need to 🔬 and 🔭, sell the product, market the vision

While this week had a whole new host of IPO filings, this was unusual in that consumer is coming back to the public markets with AirBnB, DoorDash, Roblox, and Affirm. In many of the S-1s, growth has been astonishing but investors will need to think through a time in 12 months, hopefully 🙏🏼, when things start to reopen and how will that will affect growth.

Switching gears, a common thread for me this week was spending time with founders on product launches, next round decks, fundraising, etc., and what I noticed is how hard it is for many of us, especially technical founders, to context switch between the 🔬 microscopic and the 🔭astronomic. Both are needed when it comes to building a great company.

Zooming in at the ideation/whiteboard stage, we can’t invest unless a founder is product obsessed and incredibly dialed into the details and pain they are solving for a particular user, not a market or company. Without that super narrow focus, it’s hard to build a real product that users will ❤️. Rahul Vohra from Superhuman was so dialed into product when we invested that he even built his own font, yes his own font, to give a NY Times like feel to reading email.

Zooming out, it’s also important to understand the context of where your product will fit in the market as well. Like it or not, users and buyers will always think of you relative to other products they are currently using or manual processes which you may be trying to automate. This post I wrote in 2004, “What aisle, what shelf” will help you think about your spot in existing market or creating a new market. Either way, zooming out allows you to figure out how you will be able to own a space.

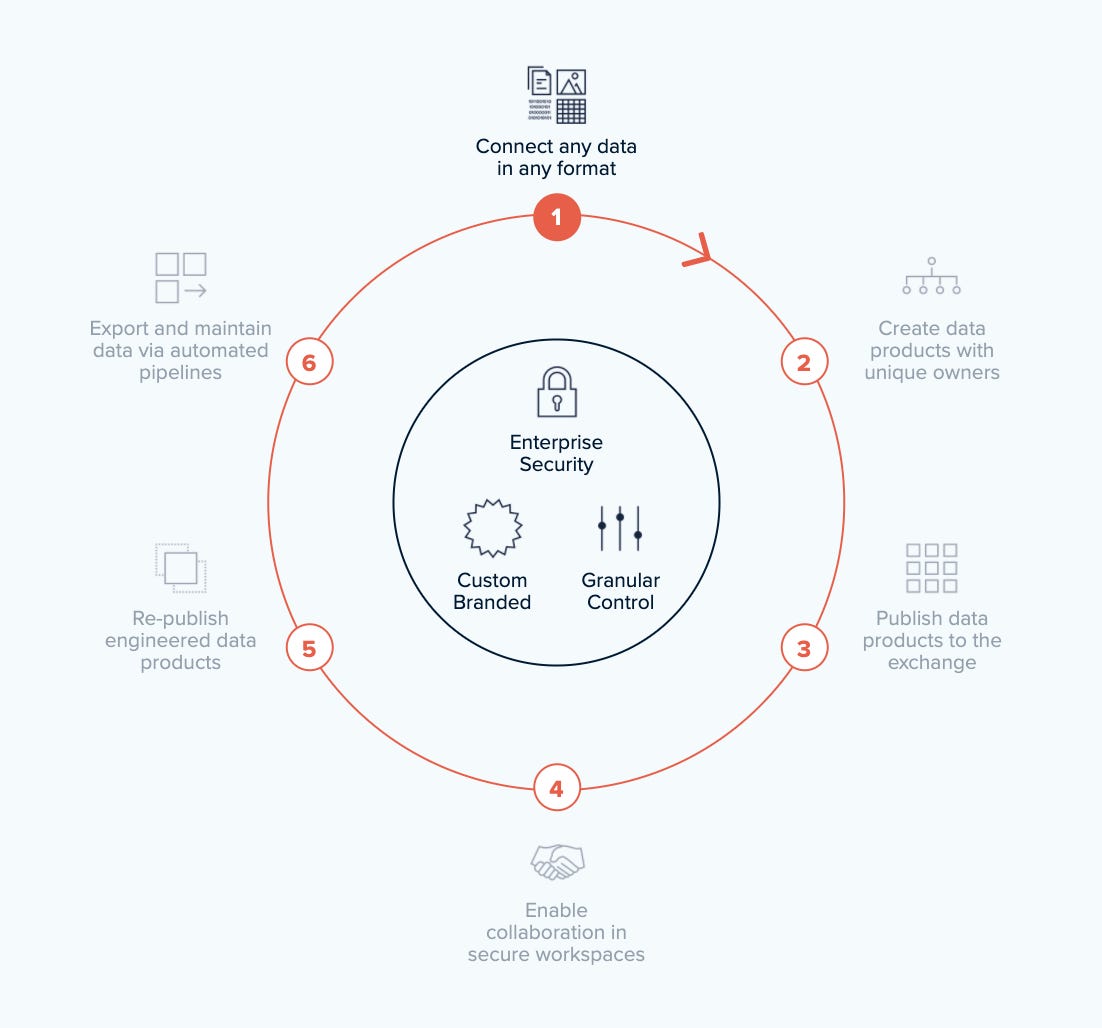

This challenge is even harder with infrastructure companies. Let’s use an example from Harbr (a portfolio co) which just announced its $38.5mm Series A funding this past week led by Dawn Capital and Tiger Global (👏🏼 to the team). Habr wants to enable every enterprise to build their own data exchange to expand access, enable collaboration, and create value. It’s a new market, and the company is continually refining its positioning. In its seed announcement in Techcrunch in May, Harbr’s messaging was around helping enterprises build online data marketplaces. This past week’s article in Techcrunch was about helping enterprises exchange and share big data troves securely. While you may think it’s a subtle difference between marketplace and exchange, in our minds and in the buyers’ minds it’s a huge difference. A marketplace connotes buying and selling of data and an exchange is broader as it encompasses sharing, collaborating, and also monetizing if an enterprise so chooses.

A picture is worth a 1000 words so what helped Harbr and what helps many infrastructure companies is putting together an image of what you do and where you fit. Here is what Harbr made so customers could understand what a data exchange is and does and where it fits within the existing investments already made in data infrastructure.

Zooming in on the user:

Zooming out:

A great marketer once told me, “Sell the product, market the vision.” This is exactly what zooming in allows you to do, focus on the product you have today solving a pain for a specific user but zooming out allows you to share the vision so when a customer buys what you have today they can also grow with you and your future product roadmap over time.

Context switching, especially when you are focused on delivering your first couple of customers is incredibly hard, and 🔑 is to know that many times this does not reside in just one founder but often in co-founders.

As always, 🙏🏼 for reading and please share with your friends and colleagues. And for those celebrating Thanksgiving, have a great 🦃 day and wonderful time with family.

Scaling Startups

👇🏼 Lead time for hiring - this can be accelerated with founder and investor networks but overall on point - so need to think ahead

I'd estimate 90% of my value as an angel investor is reminding founders that executive searches take 6 months and then another 3 months of onboarding so start now.

I'd estimate 90% of my value as an angel investor is reminding founders that executive searches take 6 months and then another 3 months of onboarding so start now.and this further 🔨 the point home

and this is what Plaid looks for when hiring

Someone asked how we hire at Plaid recently, and it reminded me of some tenets we wrote early-on: - Slope is more important than Y-axis - Everyone owns the product - Hire for spikes, not lack of weakness - Have them teach you something interesting - Did they read the docs?

Someone asked how we hire at Plaid recently, and it reminded me of some tenets we wrote early-on: - Slope is more important than Y-axis - Everyone owns the product - Hire for spikes, not lack of weakness - Have them teach you something interesting - Did they read the docs?Finally, when we’re investing at the whiteboard/pre-product stage, we look at not only the founders but also who is ready to join in first few weeks, usually engineering hires to get momentum going. Product velocity a huge sign of success and hiring velocity (need engineers/designer/product builders) closely follows. Next step then is having investors who can also help accelerate with their networks and platform like our very own Natalie Ledbetter, Head of People for boldstart and previously helped scale fintech co Stash from 27 to 300 strong.

❤️ this thread on first principles thinking and is the start of many a great company

👇🏼 Wisdom!

Founders and early investors, while not an enterprise co, story of DoorDash’s cap table is a story playing out at many a 🦄 - must read from Eric Newcomer substack

It’s a case study in why investing early isn’t enough. And it is proof that, even if you pick the right space and find the exact right company to bet on before anyone else, SoftBank can still end up owning more of the company than you. This is the story of DoorDash’s cap table.

Enterprise Tech

2020 State of DevOps Report released - thanks to Puppet for putting this together. It covers the DevOps evolution model and move towards more of a platform where DevOps teams need to think like a product team. 🔑 to this is getting the devs onboard and creating value for them on Day One as without devs, it won’t work.

We never mandated the use of the platform, so setting key results for the number of onboarded teams forced us to focus on solving problems that would drive adoption. We also look for natural measures of progress: the proportion of traffic served by the platform, and the proportion of revenue served through platform services are both good examples of that.

— From an interview with Paul Ingles at TeamTopologies.com

You have to make the platform a compelling option. Application teams should want to use the platform because it’s easier and more cost-efficient than building and maintaining their own.

And 👇🏼 this is one of the biggest gaps we still see in productivity for DevOps and why we are so excited about companies like Env0 (a portfolio co)

What is true “PLG” or product led growth? It’s not PLG if a human involved. Todd Olson, Pendo CEO, has more here in the OpenView podcast and summary

And ❤️ - key is making easier and easier, not more complicated

Getting rid of a feature that confuses users and is painful to maintain can have just as much, if not more, of a positive impact on the experience as adding some new bell or whistle.

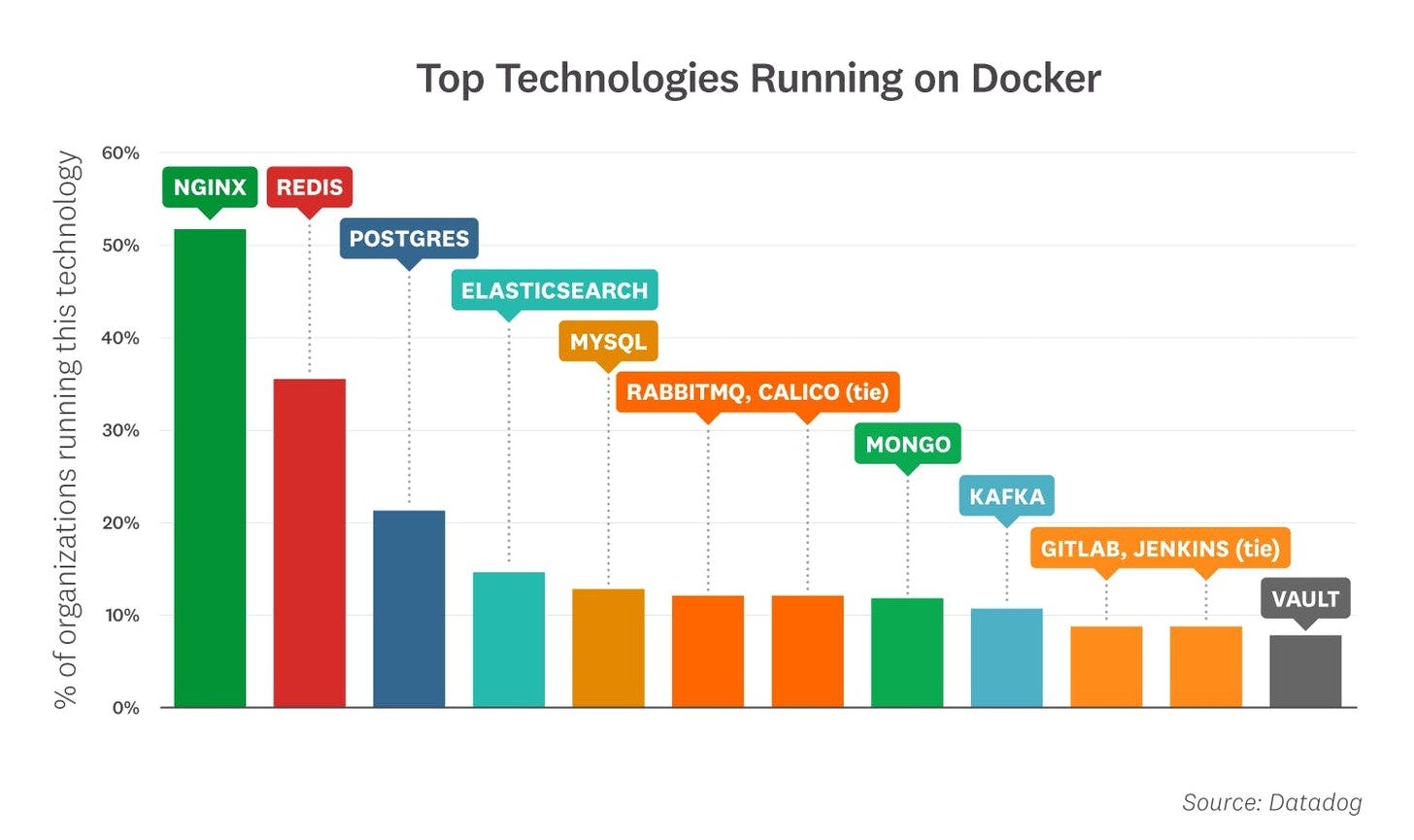

Datadog’s annual container report just released and data based on over 1.5 billion containers shows kubernetes runs in 50% of container environments, 90% of containers are orchestrated, and a majority of container workloads are underutilizing CPU and memory. Here’s a pic of the top 10 containers by technology. Based on the continued growth of containers, I still see lots of room for innovation here so stay tuned as one of my portfolio cos will be announcing mid-December 😃.

Speaking of DataDog, IBM acquired a competitor out of Germany called Instana. IBM is so far behind now in the cloud market, it will be interesting to see what other companies they buy next. For now, IBM’s focus is on hybrid cloud

“Our clients today are faced with managing a complex technology landscape filled with mission-critical applications and data that are running across a variety of hybrid cloud environments – from public clouds, private clouds and on-premises,” Rob Thomas, senior vice president for cloud and data platform said in a statement. He believes Instana will help ease that load, while using machine learning to provide deeper insights.

E-commerce continues to grow at traditional retailers as Walmart reported online sales growth in Q3 of 79% YoY and Home Depot of 80%. You guessed it, every Fortune 500 is a tech co or won’t exist and that means more software engineers, more software being built in-house, and more tools for devs to build and keep lights on 💪🏼

More from CEO Doug McMillon:

“We’re convinced that most of the behavior change will persist beyond the pandemic and that our combination of strong stores and emerging digital capabilities will be a winning formula,” he told investors on an earnings call. “Customers will want to be served in a variety of ways and we’re positioned to save them money, provide the variety of product choices they’re looking for, and deliver the experience they choose in the moment.”

And Craig Menear CEO of Home Depot:

“Sales leveraging our digital platforms increased approximately 80% versus the third quarter last year, and approximately 60% of online orders were fulfilled through a store,” he told investors on the post-earnings conference call.

Zoom is hot and one of beauties of it is that is just works, ALWAYS. Over time though, the underlying video is just a commodity as companies like Nvidia release dev tools like Maxine to bring web RTC to the masses where it too will always just work. There will be a ton of innovation to come in the video first space going after Zoom’s $125 billion market cap.

Thanksgiving reading - Ready Player Two comes out on Nov. 24 - hope it’s as good as the first!

Markets

Love this from Bessemer - no more FAANG but let’s go MT SAAS which stands for Microsoft, Twilio, Salesforce, Adobe, Amazon, and Shopify - a nice cross section of cloud infra, dev tools, app layer and SMB

Semil Shah describes the more permanent change of larger funds and their seed strategy here, in “The Quest for the Next Docusign.” IMO, those who do real focused work and help founders will still have opportunities on day one vs. later stage funds who view seed more as an option.

While not an enterprise co, Roblox was started in 2006 and filed to go public this week. It’s a gaming community for young builders and has off the chart engagement numbers with revenue from virtual currency to boot at $242mm in first 9 months of 2020, up 91% YoY

Daily active users almost doubled in the period ended September to 36.2 million. A metric the company calls “hours engaged” more than doubled to 8.7 billion.

I bring this up because gaming leads a lot of new trends in consumer and enterprise. Developers love gaming. Look at Discord the popular chat gaming app which is now being used to build many a developer community. Also Twitch and live game streaming - much of that has been copied with developer tooling demos. If I were a betting man, I’d look to Roblox, Minecraft and others to help companies have better and richer online experiences for all of us working from home as we are tired of looking at the same Zoom screen over and over.

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups