Discover more from What's Hot 🔥 in Enterprise IT/VC

Q3 was another record breaking quarter for global venture funding as it hit over $158B (CB Insights). To give you an idea of what this number means, Dan Primack from Axios says:

That's more than double the Q3 2020 total, and more than any full-year totals before 2018. Or, put another way, startups raised more in three months of 2021 than during the entire dotcom boom years of 1999 or 2000. Imagine how fat these issues of Red Herring would be...

Which leads me to my next point, where does all this 💰 go?

Talent, talent, talent - that is the lifeblood of any company and without an ability to attract, recruit, and retain talent, all the 💰 you raise goes down the drain. This is even more true today as quarter after quarter hits record funding numbers.

In fact, I spent a good part of this past week helping founders deal with talent issues. First, some of our later stage companies are getting hit up constantly by recruiters looking to poach some of the best people. My advice for those who find themselves in that situation is to proactively make sure you have your top list of 10-20 in the organization who are must-haves and for those folks to have their 5-10 who are must- haves. Review this quarterly. Also understand where they are in their option vesting, and make sure to have a proactive plan and option refresh program ready to go.

For those on day one, before you even start your company, make sure you have your top 5-10 potential hires you plan on recruiting to join you on your mission. It shows your ability as a future founder to sell a story and to show what kind of leader you are, especially if these are folks that you’ve worked with in the past. There is no better sign when raising capital on day 1 then to show up at an investor and say, I have 5-6 engineers who are rockstars ready to join me - I just need to incorporate and raise capital so I can also pay them!

Once you get the capital, then I would suggest doing this 👇🏼

And here’s a great example of the little things an amazing Head of People can do to help you optimize your talent funnel. This comes from Natalie Ledbetter, our Head of People at boldstart. Natalie was an operator beforehand helping scale Stash (fintech 🦄) as Head of People from 7 to 300 and is bringing her knowledge to our portfolio. Here’s Natalie’s direct take when working with one of our portfolio companies:

The one mistake I see time and time again is lack of personalization and WAY too much time spent on the co/product/vc's etc. With how competitive it is right now, it needs to be all about the candidate and why THEY would fit/What's in it for THEM ("employee value prop" EVP) rather than focusing primarily on the product. The product/problem space is very important, but showing the candidate that you took the time to reach out to them SPECIFICALLY is crucial and improved your chances of getting a response. Even if they aren't looking, making that connection could lead to something in the future-- this makes you stand out

And Natalie goes above and beyond and even share’s a few sample emails. Here’s one example. The details matter!

Imagine having this advice for your whole funnel down to streamlining your interview process and having an offer letter in hand to reduce time to close. Personalizing and moving quickly matters in this insane market!

Finally, I spent time with an executive recruiter who is leading a search for one of our portfolio companies, and he reiterated how hard it is to get people’s attention. There are so many 🦄 which are private where employees have not had a chance to create real wealth yet and do not want to leave until they do so. Which means when hiring for VPs, for example, betting on up and comers is the way to go. Find the folks who are super hungry and want a step up in role and while they don’t have that senior experience, they are more than capable to step in and make it happen.

In fact, oftentimes in a search for an early company in terms of operations but not in funding. founders can over index on experience. And the problem with that is:

Remember, no talent, no product and no company! If you want more of Natalie’s advice check out this podcast she did on the Business of Being Cloud Native.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Food for 🤔

The beauty of remote first and the problem 👇🏼 - this is not the first time I’ve heard of this issue

Great reminder of the feeling from the last boom before the dot com bust

Enterprise Tech

😲 Chronosphere raised $200M Series C at 🦄 valuation - next gen observability platform with insane growth numbers!

“A mere two years ago, Chronosphere was still in stealth mode and it was just my co-founder, Rob Skillington, and me working pandemic-style. I was huddled in the laundry room of my condo, and Rob was working from a desk tucked into a corner of his living room. Blink – Chronosphere is a unicorn. Going from zero to unicorn status in 2.3 years, this is rare. In fact, according to Pitchbook, Chronosphere is now in the top 10 fastest B2B SaaS unicorns. EVER.

Last month we shared the news that Chronosphere’s multi-million dollar ARR (Annual Recurring Revenue) grew by 9x so far in 2021, and that we are doing 6- and 7-figure deals. This means Chronosphere’s unicorn status happened on the back of record-breaking ARR growth.”

And here’s why - observability, incident analysis, chaos and load testing all matter - its complicated as hell! Here’s deep dive into the massive Facebook outage last week

Tons of more details on the FB outage yesterday. Lots of interesting details; especially how they came back online. I fully expect an OSDI/SOSP paper in a year or two on chaos experiments that take out the backbone network.

Tons of more details on the FB outage yesterday. Lots of interesting details; especially how they came back online. I fully expect an OSDI/SOSP paper in a year or two on chaos experiments that take out the backbone network.

Now that our services are fully restored, we are sharing more details about yesterday's outage. https://t.co/SwDmBGZaZU

Now that our services are fully restored, we are sharing more details about yesterday's outage. https://t.co/SwDmBGZaZU Facebook Engineering @fb_engineering

Facebook Engineering @fb_engineeringMore on our reliance or dependence on AWS and us-east-1 in particular which is quite frightening 😧 and when us-east-1 did go down a few years ago, it was only s-3…

One of the hands down most sobering conversations I’ve ever had was with a bunch of Very Savvy Investment Bankers about what exactly a total failure of us-east-1 would look like economically. The *best case* outcomes closely resembled a global depression.I’ve gotten a lot of smug responses from AWS fans that I don’t know what I’m talking about, and that frankly makes me want to run for the hills away from depending on services like this.

One of the hands down most sobering conversations I’ve ever had was with a bunch of Very Savvy Investment Bankers about what exactly a total failure of us-east-1 would look like economically. The *best case* outcomes closely resembled a global depression.I’ve gotten a lot of smug responses from AWS fans that I don’t know what I’m talking about, and that frankly makes me want to run for the hills away from depending on services like this. matt blaze @mattblaze

matt blaze @mattblazeState of Software Quality and Testing from SmartBear - testing continuing to shift ⬅️

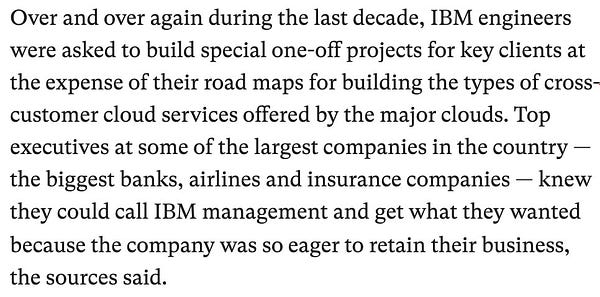

Must read from Protocol on how IBM lost its way and great reminder for startups, choose your first customers wisely…

💯 - great 🧵 on data stack as code

More on the data stack - must 🎧 from Seth Rosen from TopCoat Data

💯

Privacy engineering on 🔥 as Gretel raised a $50M Series B and Duality raised a $30M Series B

Duality - empowers organizations to extract business value from sensitive data by enabling secure data collaborations within their ecosystem

Gretel - Privacy engineering tools delivered to you as APIs. Synthesize and transform data in minutes. Build trust with your users and community.

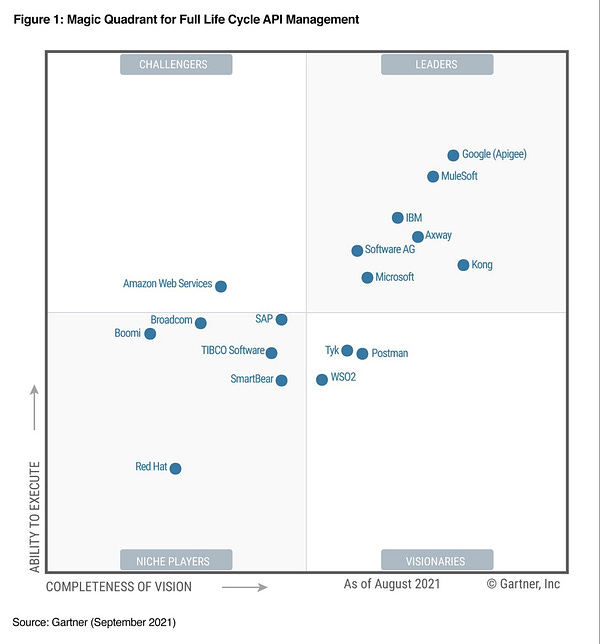

Gartner Magic Quadrant for APIs

Markets

Coding platform GitLab aims for nearly $9 bln valuation in U.S. IPO

Notion raises at $10B valuation from Coatue and Sequoia

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups