Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #289

Why lead investors matter + simple portfolio triage for seed investors

Once we cycle out of this 🐻 market, perhaps we can all focus on going back to basics starting with round construction. These are the times I encourage founders to remember that the relationship between investors and founders is a marriage that one should enter carefully. During the last two years, both sides optimized for speed, FOMO, and price over relationship. Moving forward, I hope we can learn from this current correction and come to a more balanced approach and take the time necessary to truly find the right partner and not just capital.

To that end, I hope that founders have a lead investor and an experienced one at that. One that can help them feel like this when everyone else is panicking.

Founders need investors who CHEER when times are tough, CHALLENGE when things are looking too good, and CHILL when founders sometimes need downtime.

What I saw in multiple downturns in the past was that those that optimized for as many influential firms and angels on their cap table were also the same companies that did not have great stewardship and governance as no one had enough skin in the game to view the investment as more than an option.

Secondly, when choosing a lead investor, I highly suggest founders ask their investor what the cash reserve strategy is to help support founders on the way up as well as when times are tough…assuming they are doing what they need to do 🧵

Finally, seed investors, I hope you are triaging your portfolio and monitoring cash and operations from the top down so you never feel like you’re in panic mode. A great and simple start is that you should have a list of companies triaged by runway in months:

< 12 mos

<18 mos

<24 mos

>24 mos.

Along side that, you should also have a sheet

Pre-PMF

<$1M ARR

<$5M ARR

<$10M ARR

>$10M ARR

The second set of metrics will allow you to align runway to stage of company. Armed with this data, you can constantly triage and help founders think through milestones to get funded and prep them well in advance of where we are today. With simple monitoring you would have already figured out who is best positioned to raise an outside round now, who you should invest more into proactively and double down to save founders time from a raise and give more room to hit milestones, and finally figure out which teams need tough ❤️.

Remember creating new categories is brutal and rule #1 is to never run out of 💰.

The spigots are now closed for anything past Series C and folks are adjusting to round sizes at Series A. If you’ve already been well prepared and have plenty of runway this is going to be great time to hire A+ talent and build your business while many pullback.

May next week be mostly in the 🟩 📈.

Scaling Startups

👇🏼 for board meetings, founders have been going to this more and more and I must say it’s been incredibly efficient especially when delivered a few days in advance so comments can be shared and answered and we can focus on real discussion

Slide decks hide can shallow thinking. Narratively structured memos are harder to write because they require better thinking. It’s worth it.I see a lot of organizations relying too much on slide decks relative to actual written memos for their internal communications. Presentations are great but prose has a unique value in clarifying thought and creating an unambiguous record.

Slide decks hide can shallow thinking. Narratively structured memos are harder to write because they require better thinking. It’s worth it.I see a lot of organizations relying too much on slide decks relative to actual written memos for their internal communications. Presentations are great but prose has a unique value in clarifying thought and creating an unambiguous record. Matthew Yglesias @mattyglesias

Matthew Yglesias @mattyglesiasReminder of what solid used to be

Founders, need cash? Don’t forget this and btw back in some tough times I can count many a portfolio co who actually sold their time, yes consulting work, to make it through lean times - we’re not there yet but good to know

This is pretty awesome - real-time startup valuation data from AngelList

Enterprise Tech

Hi folks - we now have a new mythical creature, a centaur (no emoji, sorry) which is a private company with ARR > 100M - coined by Bessemer - more on their annual cloud report

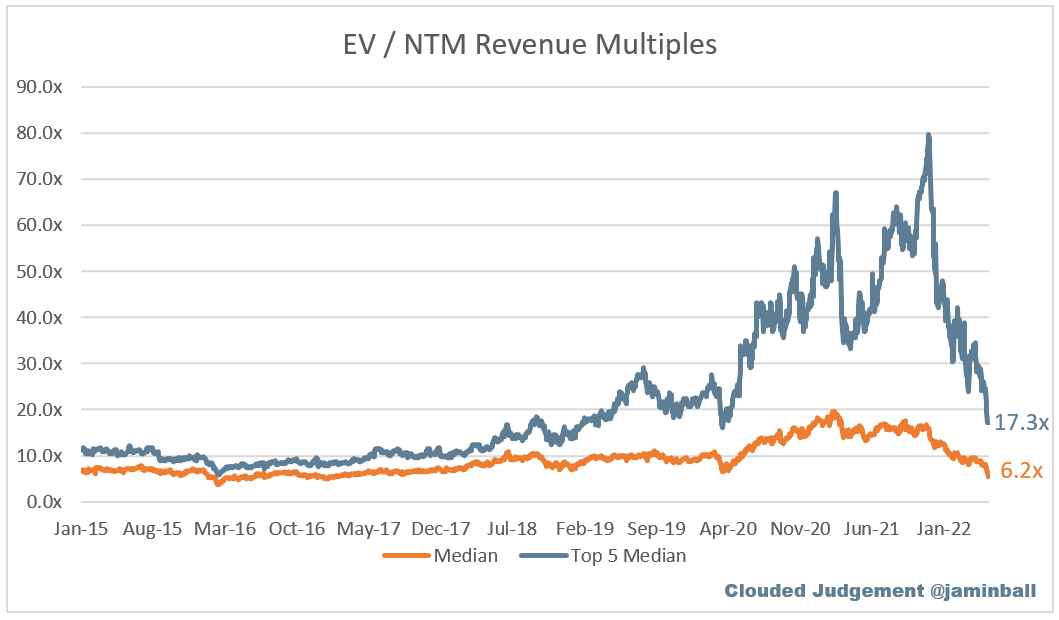

Current multiples - huge difference between Top 5 and everyone else (Clouded Judgement - Jamin Ball)

I highly encourage you to subscribe to this newsletter and curious how far this chart will drop

Lots of fundings being announced now but clearly this and others below were done pre-market meltdown.

Rippling raises at $11.25B valuation - makes it unbelievably easy to manage your team's payroll, benefits, computers, and appsChainalysis (blockchain data analytics/security) raises at $8.6B valuation

Collaborative ML platform co Hugging Face raises at $2B valuation from Lux, Sequoia, Coatue

Some stats:

fastest growing community & most used platform for machine learning! With 100,000 pre-trained models & 10,000 datasets hosted on the platform for NLP, computer vision, speech, time-series, biology, reinforcement learning, chemistry and more

>10,000 companies are now using Hugging Face to build technology with machine learning.

Grew from 30 to 120 employees

💯

Great 🧵 - let’s see who the tourists are vs. the folks for the long term after this week

Google building out blockchain infra team to help devs (CNBC)

Going forward, Google could devise a system other companies could employ to make blockchain data easy for people to explore, while simplifying the process of building and running blockchain nodes for validating and recording transactions, Zavery said. He added that Google’s tools can work in other computing environments, such as Amazon Web Services.

Markets

🤣

SoftBank’s Funds Post $27 Billion Loss on Plunging Tech Investments (NY Times)

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups