Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #292

How we thought about scaling our seed firm from a team of 2 + $1M proof of concept fund to a partnership of 4 & $367M of new funds

So we announced this…

More importantly, we promoted two of our team members, Shomik Ghosh from Principal to Partner and Ellen Chisa from Founder-in-residence to Partner. This is a huge milestone as after 12 years founding boldstart ventures, this is the first time we’ve expanded our partnership. Going from a two person firm and expanding to add operating partners like the amazing Natalie Ledbetter, Head of People and Platform, was a big enough challenge to how a small fund operates. Adding new investment partners to the team brings a whole other dynamic.

For solo GPs and others running small firms like Eliot and I, let me share with you some of our thought process around growing our team. The first question Eliot and I were faced with was how do we keep supporting our founders from day one and continue to be the first call until exit. Along those lines, we mapped out how much time we spent in various areas from meeting new founders, supporting existing ones, raising capital and all else we needed to do to grow a firm.

Ultimately we landed on an operating partner model and given that we have often written about capital being more of a commodity, than people, enter Natalie Ledbetter. Natalie came referred to us from Dipti Salopek who was VP People at Snyk, a portfolio co, and has an operating background having helped scale Stash in the fintech space from 7 to over 300. She’s taken a huge load off us and helped implement a best-in-class framework to think about hiring, put systems in place, and also attract and find talent. Over the years we added Ab Gupta, formerly VP Ops & Strategy at Kustomer, another portfolio co to help founders with team dynamics, ops, and all of the other things technical and product driven founders are experiencing for the first time on the business side.

Finally, Eliot and I were faced with the question of getting bigger and if so, how big. One thing we did know based on experience is that we never wanted to get so big that we would leave our swim lane of finding founders and leading rounds at company formation. We know that in venture you can either go big, go niche, or go home. We know our niche, partnering with highly technical founders from day one and having the capital to back them through exit. Once we decided we wanted to get bigger then naturally it came down to adding future partner level talent.

Taking a step back, Eliot and I had a hard time raising capital until the middle of 2019 so our first 9 years of existence was quite rough. I remember the many discussions with Eliot on who the right partner could be and many a potential LP suggested adding an established partner to our firm who already had significant LP relationships and could jumpstart our fundraising process. As much as we were tempted by the notion and shortcutting our fundraising process, we decided to stick to our focus and our unusual way of partnering with founders and thought best to build from within. Fortunately, we got to know Shomik Ghosh from our LP Top Tier Capital. While not on the LP side, we collaborated with Shomik over a couple of years as he was leading direct investments in enterprise startups like CircleCi, Shape Security and Anaplan. We first met Ellen many years ago as we were an investor in her startup Dark where she was also CEO. She brings an incredible product and engineering mentality to the team and always offers the founder perspective.

Fast forward and we couldn’t be more thrilled to have them both as Partners. What I ❤️ most is how both Shomik and Ellen encapsulated their learnings during the last two years which shows the true boldstart culture of being a true believer for founders from day one but also done with their own flair and creative twist.

Here’s Shomik’s learnings…

And Ellen’s

As always, 🙏🏼 for reading and please share with your friends and colleagues!

Scaling Startups

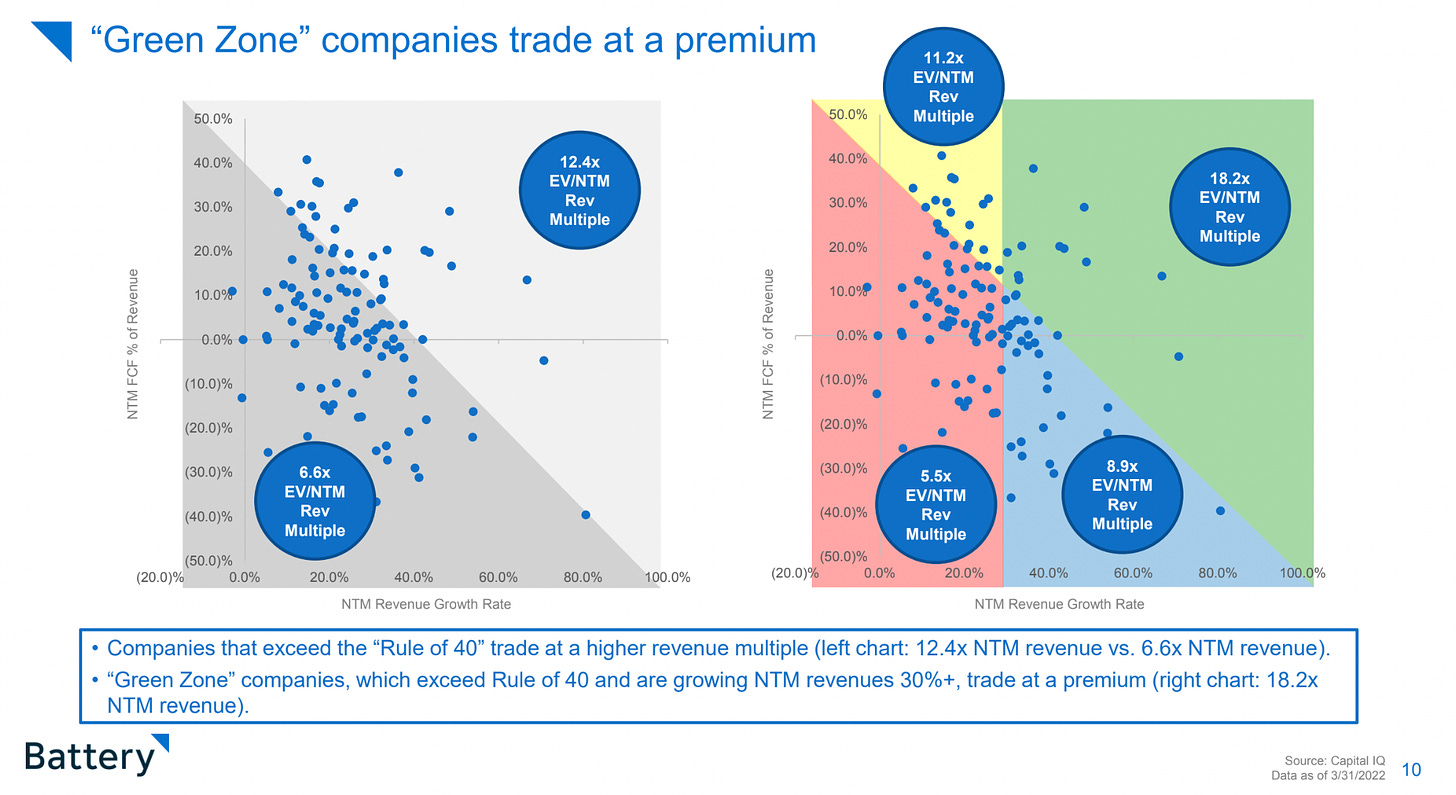

Battery Cloud report is now quarterly - great slides to understand public multiples which are having an impact on what investors pay for privates…rule of 40 is back which is idea that SaaS companies growth rate + profit margin should be >40% (slides here)

PSA from Grant Miller, founder/CEO of Replicated - replanned for profitability in 18-24 mos, sadly some amazing folks let go - you can check them out here if growing.

Where we went wrong

In trying to inspect deeply how we got to this point, I realize that there are many symptoms and contributing factors. We hired too fast in some areas and too slow in others. We focused on company building when we needed to keep our attention on customers and product execution. We needed too much hand-holding to get customers to the level of integration that would make them highly successful with our product. Various team members tried to get my attention on these issues, but I didn't heed their advice. I should have prevented some of these issues from coming and others I should have caught sooner. We started addressing some of these challenges in recent months, but unfortunately the impacts of those changes aren't realized overnight.

The path forward

By making this adjustment, we're able to confidently assure our customers that the tools & services they rely on to power their enterprise distributions will be available to them for the long term. We have more than doubled our straight-line runway to over three years. Additionally, our adjusted growth plan puts us on a path to achieve profitability in the next 18-24 months (giving us an infinite runway).

Yep, founders many times think just adding that one more feature will change everything…

How VCs can help 🤣

Enterprise Tech

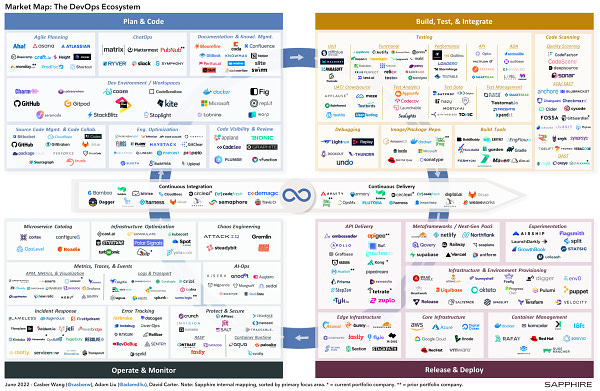

Great overview of DevOps space from Sapphire Ventures and @CasberW and yes, supply chain security is one of 5 top areas for what’s next - read on here

Trends in centralized cloud platform teams as laid out by HashiCorp - Regarding the above, the idea of shift left is for ops to be done by more devs like security from Snyk or Jit or environments from Env0 or integration testing from AtomicJar…this is quite an interesting trend that HashiCorp laid out in its earnings transcript around centralized cloud platform teams that web scale cos have now but not yet prevalent in Global 2000

As companies undertake cloud migrations or digital transformation, CIOs often find themselves in a difficult position of sifting through the disparate pieces of infrastructure and cloud resources that their various teams have deployed in the past, usually with little or no coordination. This has cost implications, but also efficiency applications, siloed teams with siloed infrastructure and little strategy underlies at all.

When developers want to develop and ship a new product to serve customers, they often encounter constraints and delays from their Ops, security and networking teams who would like to place some level of governance. HashiCorp is sold to these various silo teams to help them with their immediate cloud infrastructure issues for years, helping them with provisioning, security, networking, and application delivery. However, we are now being brought into help companies standardize their cloud infrastructure across teams. In many instances, in fact, those early adopters of our products are now being assigned to be the platform teams for their organizations as a whole.

The Platform team is the group to consolidate and standardizes cloud infrastructure for an entire company. It controls cloud infrastructure as a single cost center, great standard processes, and establishes compliance protocols for applications and infrastructure. With this central team in place, companies can control costs and enforce consistent security policies allowing developers to deploy applications with wireless friction. Our cloud operating model with an integrated stack of products, including Terraform, Vault, Consul and others enable to these platform teams to succeed.

💪🏼 Huge congrats to Reco on its $30M Series A led by Zeev Ventures with Insight Partners joining - @boldstartvc led the seed

My partner Eliot Durbin has more on why we’re so excited about a new category built around collaboration security with business context…and TechCrunch here

Also this video will tell you more:

🔥 up about investing in Valence.xyz and helping traditional brands onboard into the world of NFTs - more to come…

A group of technologists, investors and sports owners today announced the launch of Valence, a software platform and infrastructure to power end-to-end Web3 experiences for brands. Valence allows creators and brands to securely utilize Web3 tools to engage with their audience, one-to-one, at scale.

The Chicago Cubs will also work with Valence on the product roadmap for the sports sector, and integrate the Valence technology to drive the next generation of its fan engagement strategy. The Valence web3 infrastructure provides brands with best-in-class NFT minting, bespoke digital world building, and interoperable identity authentication.

The future of fan engagement means leveraging new technology that empowers fans to engage with their favorite team and other fans in new ways whether in the venue or through a virtual experience,” said Ricketts.

“The Valence engine will provide one-click NFT minting capabilities, SMS based wallets to store assets, and the ability to display those assets in virtual galleries alongside the rest of the community. We offer fans a meaningful alternative beyond jpegs and flying avatars, facilitating deeper consumer engagement with the things they love, and the infrastructure for brands to execute long term Web3 strategies.”

🌊 of 💰 still waiting to pour into crypto from TradFi - Fidelity hiring!

A Fidelity Investments subsidiary, launched a few years ago to let institutional investors store and trade bitcoin, plans to double its head count this year as it predicts rising demand for cryptocurrency amid market volatility.

Fidelity Digital Asset Services LLC plans to hire 110 tech workers, including engineers and developers with blockchain expertise, to build digital infrastructure to support services for cryptocurrencies beyond bitcoin, said Tom Jessop, its president. The subsidiary also plans to add 100 customer-service specialists.

What’s the quantum internet? one day! (NY Times)

The result: Alice was entangled with Charlie, which allowed data to teleport across all three nodes.

When data travels this way, without actually traveling the distance between the nodes, it cannot be lost. “Information can be fed into one side of the connection and then appear on the other,” Dr. Hanson said.

The information also cannot be intercepted. A future quantum internet, powered by quantum teleportation, could provide a new kind of encryption that is theoretically unbreakable.

Solana…down again

Markets

Hashicorp earnings…amazing only 9% is cloud!

We're excited to share with you that Q1 was a solid quarter for HashiCorp as we exceeded our guidance with revenue of $100.9 million, representing year-over-year growth of 51%, along with the trailing four quarter average Net Dollar Retention rate of 133%. We're also pleased to announce that during Q1, we had our second customer reach $10 million in annual recurring revenue. The most recent transaction by this global financial institution with a new commitment to console during the quarter, one of our largest console transactions ever.

… we added 49 customers with greater than or equal to $100,000 in annual recurring revenue, reaching a total of 704. Our HashiCorp Cloud Platform offerings reached $8.8 million revenue, representing 9% of subscription revenue in the quarter.

Crowdstrike earnings - speaking of Rule of 40, Rule of 78! (transcript here) - cybersecurity spend is one of few areas which will remain steady in coming years

The CrowdStrike team achieved another outstanding first quarter. Building on our historic Q4, this quarter, we delivered net new ARR of $190 million, topping our expectations. We delivered ending ARR growth of 61% year over year to exceed $1.9 billion, record non-GAAP operating profit of $83 million, and free cash flow margin of 32%.

In eight out of the last 10 quarters, we have delivered 30% or greater free cash flow margin. Our powerful combination of growth, profitability, and cash flow is reflected in our continued performance well in excess of the SaaS industry's Rule of 40 benchmark. In Q1, we achieved a Rule of 78 on a non-GAAP operating income basis, and when calculated on a free cash flow basis, a Rule of 93.

and wow on product upsell and attach rate

Given subscription customers with four or more modules surpassed the 70% milestone and is now commonplace, we are retiring this disclosure and raising the bar by introducing a new metric customers with seven or more modules, which reached 19% at the end of Q1. We are pleased with our strong module performance across the Falcon platform in both our core and expansion markets. I'd like to highlight a few standouts in Q1. First is Falcon Complete, our industry-leading full turnkey managed detection and response offering that uniquely blends technology and services to stop breaches for customers of all sizes.

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups