Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #296

Refocusing on relationships vs. transactions, founders who are more 🥩 vs. sizzle 🥓 will rise back to the top

🙏🏼 Q2 is finally over. And yes it was quite ugly.

Since this data usually lags a few months, here is my expectation for what Q3 will look like - yes, vaporized like a Thanos snap of the fingers.

Since I am 🥛 half full kind of person, here’s the silver lining. Let’s call the last 2 years an aberration or a COVID blip and prior to that while the pace of rounds closing were increasing quickly, founders and investors still had time to be more relational vs. transactional in their approach to fundraising. Relationships have always mattered but that was forgotten during the last 24 months when preemptive round was stacked on top of preemptive round. During turbulent times, a founder’s prior choice of investor is magnified when strategic decisions on burn and value creation are being made. The good news is that due to the slowdown and lack of FOMO, investors and founders are back to basics with more time for relationship building during diligence.

What this also means is that those founders who are more 🥩 than 🥓 sizzle will rise to the top again. 🥩 founders are those who are maniacally focused and obsessed about solving a customer pain by building a differentiated product and focused on the basics. They tend to undersell versus oversell. They are the ones who know what the definition of customer is, a paying customer. They can walk you through the customer journey in detail and explain how their product is used by each and every of the first handful of customers and what the deal sizes are. They talk about TAM after first nailing the initial, microscopic wedge of customer pain and talk about the expansion opportunities but don’t lead with it.

🥓Sizzle founders talk about TAM first, are amazing at telling a story but the product and customer obsession is not all there. They tend to oversell and exaggerate where the company is versus where it truly is. When you dive deeper into numbers and diligence and customer use cases, the answers become less clear.

During a massive bull market filled with FOMO, the founders who told amazing stories and sold the idea of huge TAMs were the ones who raised the most the quickest especially when credit was given way ahead of actual traction. In today’s funding environment which is more of a reversion to the mean, markets are back to rewarding true value. If you’re a founder and getting ready to fundraise, I’d wait until the Fall when the markets settle. I would spend the summer continuing to iterate on product, landing more customers, and preparing your story with meaningful proof points. Build a believable budget, set clear goals or milestones on what you expect to achieve with the capital, ensure you have a handful of customer references who have been prepped in advance, and create your list of key future hires. Let the results tell your story and you’ll have a fundraise based on 🥩.

As always, 🙏🏼 for reading and please share with you friends and colleagues. And for those celebrating, I hope you have a Happy 4th 🇺🇸 of July!

Scaling Startups

The power of momentum both positive and negative.

One of my mantras for sure

Enterprise Tech

Congrats to Mathilde and Front (a portfolio co) on amazing milestone

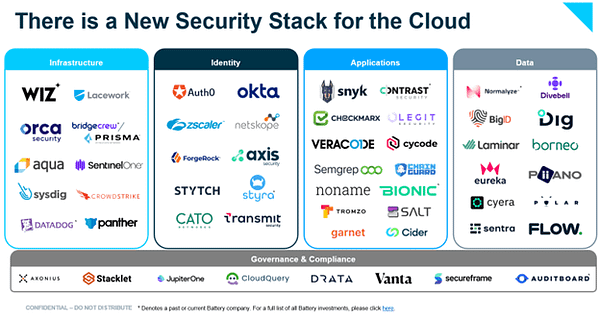

Rebuilding the cloud security stack from Battery. Great to see a few boldstart port cos on there like Snyk, BigID, and CloudQuery

$1.3B equity raised according to Crunchbase, initial rumors had exit at $25M for BlockFi but Zac clarifies that with ratchets it could go up to $240M, regardless still a stunning and fast collapse

Yesterday we signed definitive agreements, subject to shareholder approval, with FTX US for: 1. A $400M revolving credit facility which is subordinate to all client funds, and 2. An option to acquire BlockFi at a variable price of up to $240M based on performance triggers.

Yesterday we signed definitive agreements, subject to shareholder approval, with FTX US for: 1. A $400M revolving credit facility which is subordinate to all client funds, and 2. An option to acquire BlockFi at a variable price of up to $240M based on performance triggers.Also another massive down round for a lending and payments co from WSJ: “Klarna to Raise Fresh Cash at Slashed $6.5 Billion Valuation - The deal would be a huge comedown for the company, which investors valued at $45.6 billion in 2021”

Wise words from Tom 🧵

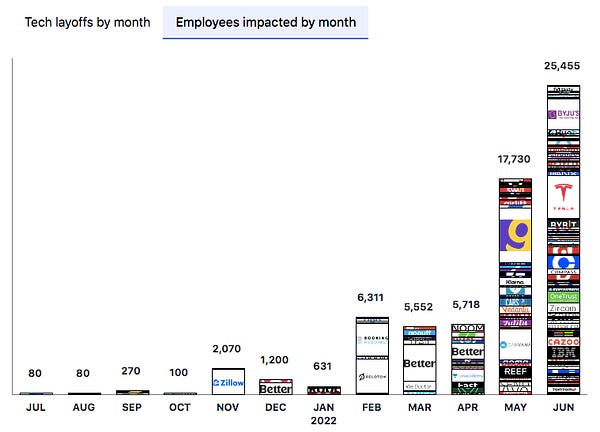

Sadly, this is list is growing way too fast

Why real world utility tokens will be next wave for those builders 🧵

Great to see even old school McKinsey educating its large enterprise clients that “developer experience” or DX matters…walks through the whys and 10 steps to ensure success - lots of startups already building around this…

Much like employee experience more broadly, great DX makes life easier for developers, which in turn translates into higher performance. Developers today often spend a lot of time fighting against bottlenecks and organizational red tape, sending emails, going to meetings, and chasing people they need just to complete their work. Common tasks that are cumbersome for developers include deploying code to production, creating change requests, ramping up infrastructure, figuring out which tooling to use for things such as security testing, or establishing a new component and integrating it into an existing platform.

Great question with lots of solid comments

This is a short and quick read on how China uses AI to polices its people - must read article ‘An Invisible Cage’ from NY Times

Markets

Unfortunately, this will be true. The question is how severe for which kinds of companies - security will likely be less impacted versus other areas

Are Venture Returns About to Cycle from Cambridge Associates? Conclusion is yes, prices are quite inflated, but will not be negative returns like during the dot.com era.

Public market valuation movements typically make their way into private market valuations across subsequent quarters. The dot-com bubble may have burst valuations quickly in the public markets but ended up slowly deflating US VC vintage year performance over several years, making certain vintage years—such as 1999—essentially irreparable. Today, we expect sustained declines will most impact investments made during this peak valuation period as the underlying companies seek subsequent rounds of outside financing, as well as companies that cannot sustain the revenue or business growth required to achieve an acceptable return and need to be revalued. Even if there is an overall 50% decline in year-end 2021 US VC market values, the theoretical gross multiple on the index would be 1.6 times, well within historical levels and experienced investor expectations.

What Meta is telling its employees:

The company must "prioritize more ruthlessly" and "operate leaner, meaner, better executing teams," Chief Product Officer Chris Cox wrote in the memo, which appeared on the company's internal discussion forum Workplace before the Q&A.

"I have to underscore that we are in serious times here and the headwinds are fierce. We need to execute flawlessly in an environment of slower growth, where teams should not expect vast influxes of new engineers and budgets," Cox wrote.