Discover more from What's Hot 🔥 in Enterprise IT/VC

While there is a constant stream of news on TechCrunch and Twitter about new funding rounds, including this pre-seed deal from a16z this past week, what happens

to companies post funding?

Seeing this tweet from liveblocks, a boldstart portfolio co, this past week got me 🤔 about the often missed importance of sustaining momentum once you “hello world.”

While I won’t debate the merits of when and how to announce your funding and product launch, let me show you a few examples of what liveblocks has shipped from a content and product perspective since its funding announcement. IMO, the MOST IMPORTANT aspect of your launch is not the day of launch but every day after! If you don’t have a plan and a content calendar of original content and product releases planned for after you launch, then you’re likely not ready to announce.

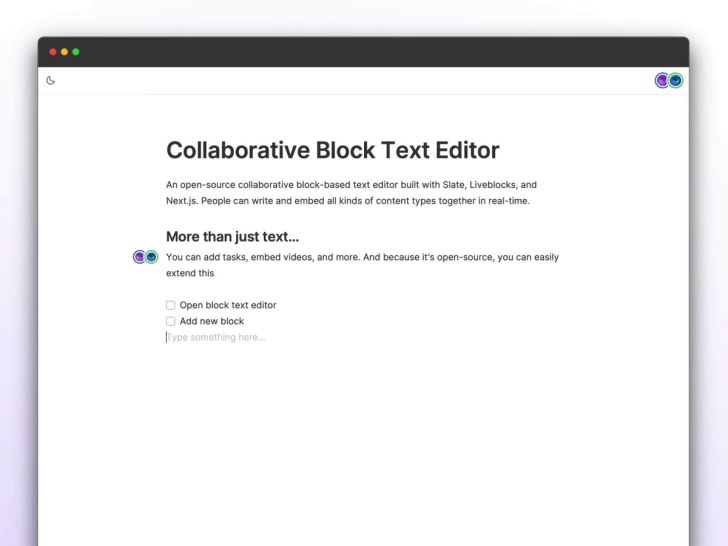

What’s clear is that liveblocks knows its audience and goal for each and every post - get more developers to understand how and why to use the product. Besides being consistent, liveblocks also keeps setting a new level for what interactive tutorials should look like for developers. You can see that evolution from the initial announcement of storage block in March to the latest sample gallery included below.

Here’s the initial funding announcement from March 2022 🧵.

In June, it followed up with a detailed post for engineers focused on the age old problem of undo/redo and how to realize and sync offline and online. It also generated some nice buzz on hacker news.

All of this resulted in accelerating growth as the company passed the 2 million connections mark in June. Of note, it took 5 months to get to the first 1 million and only 2 months for the second.

In July, Chris, who heads up devrel, wrote a tutorial on how to animate multiplayer cursors.

Finally, this past week, liveblocks launched Examples Week where it released a new example each day and showcased an interactive gallery so devs could check out the code and play with live demos.

Not only did liveblocks launch the ability for devs to build their own Notion like clone (see above) but it also showcased an interactive spreadsheet on Friday.

Net net, launching is great, but unless you plan ahead with a full 📆 of content and releases over time, your launch may be wasted.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Setting stage for product walkthroughs vs. feature by feature - great advice 🧵

Following up on my tweet last week on seeing smaller rounds and how they force constraints and focus

The ongoing debate between who should be in your seed round and the value add from investors - angels, seed funds, A and multistage firms 🧵 - thx for the shoutout @vsodera!

Noob behavior. Why this is shit: 1. $50k of $500M (.01%) = option bet 2. .01% = post wiring, def won't be helpful 3. Fund gets access & info to share w/competitors further along 4. $50k less on cap table for actual helpful angels 5. If fund doesn't do Series A = signal risk💀Another day, another pre-seed founder telling me they are taking a $50k check from a $500m series A fund because the fund has been ‘soooo helpful’ already. Sigh.

Noob behavior. Why this is shit: 1. $50k of $500M (.01%) = option bet 2. .01% = post wiring, def won't be helpful 3. Fund gets access & info to share w/competitors further along 4. $50k less on cap table for actual helpful angels 5. If fund doesn't do Series A = signal risk💀Another day, another pre-seed founder telling me they are taking a $50k check from a $500m series A fund because the fund has been ‘soooo helpful’ already. Sigh. Jenny Fielding @jefielding

Jenny Fielding @jefieldingMany success stories take a long time

Enterprise Tech

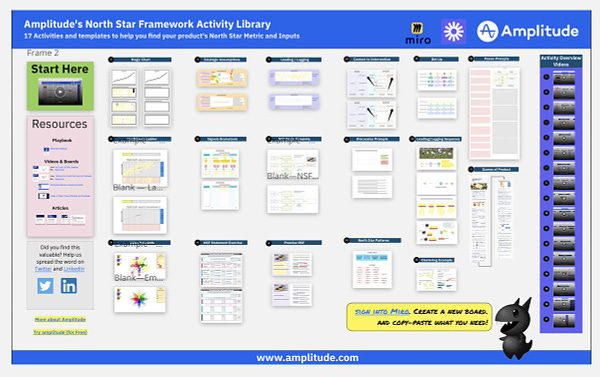

Amplitude templates on finding your North Star Metrics and inputs

Notice, Nat, former CEO of Github, led the round. Seeing more and more angels actually lead rounds at seed and even A - interesting trend to 👀

John Carmack is one of the best engineers in the world and a national treasure. Thrilled to be leading this round and supporting him in building Keen Technologies!I mentioned this in the Lex interview, but it is official now: Keen Technologies, my new AGI company, has raised a $20M round, led by @natfriedman and @danielgross, with @patrickc, @tobi, @sequoia, @CapitalFactory, and Jim Keller participating.

John Carmack is one of the best engineers in the world and a national treasure. Thrilled to be leading this round and supporting him in building Keen Technologies!I mentioned this in the Lex interview, but it is official now: Keen Technologies, my new AGI company, has raised a $20M round, led by @natfriedman and @danielgross, with @patrickc, @tobi, @sequoia, @CapitalFactory, and Jim Keller participating. John Carmack @ID_AA_Carmack

John Carmack @ID_AA_CarmackWhere to find amazing technical content on what’s next in cybersecurity

A list of recent conference materials: BlackHat - no videos, but slides blackhat.com/us-22/briefing… BSidesLV youtube.com/channel/UCpNGm… Defcon youtube.com/user/DEFCONCon… Troopers youtube.com/user/TROOPERSc… ARE41 m.youtube.com/c/defconswitze… SANS ransomware summit

A list of recent conference materials: BlackHat - no videos, but slides blackhat.com/us-22/briefing… BSidesLV youtube.com/channel/UCpNGm… Defcon youtube.com/user/DEFCONCon… Troopers youtube.com/user/TROOPERSc… ARE41 m.youtube.com/c/defconswitze… SANS ransomware summit

The leap from PLG and SMEs to large scale enterprise is a huge opportunity but also fraught with peril - read more on why AirTable views itself as more competitive with ServiceNow and Salesforce than a Monday.com or Asana. Will need to leverage bottoms up motion with a top down one as well, provide all of the security, SSO…to be enterprise ready (see guide here). Easy to say but will require a mindshift and infusion of enterprise DNA.

Despite the prowess and financial muscle of Salesforce and increasingly ServiceNow, Liu is confident Airtable can best them in at least some deals. Airtable’s cloud-native background, ability to sit on top of a CRM or ERP and user-friendly interfaces are all key competitive advantages, from his perspective.

The fact that Airtable doesn't need to own a CRM or ERP system and has never been on-premises means the company can deploy much faster and more simply than other enterprise software — sometimes in hours or days, rather than months.irtable.

Looks like a market begging to be disrupted by open source

Unlike in the last crypto meltdown in 2018, many large institutions still committed to the future - here’s an example of who’s investing - nice to have port cos Blockdaemon on here with Goldman Sachs and Citi as investors along with Amberdata with Citi

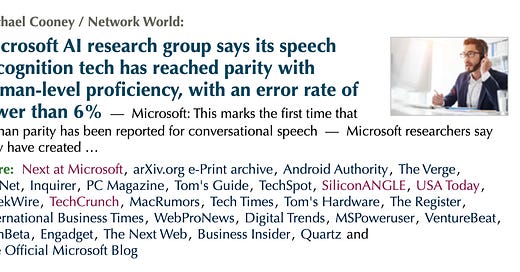

Model training costs coming 📉

How do you build a community - 5 Laws for Community Led Growth from Bessemer VP

Nuggets of wisdom from Alan Feld, founder of leading fund of funds Vintage Investment Partners and also former VC - “6 Lessons From Being a Venture Capitalist During a Market Decline”

Markets

In case you are wondering what is happening in the market, this Goldman Sachs research blurb hits all of the highlights

The S&P 500 index has catapulted 17% in eight weeks to reach our year-end target of 4300 as investors have embraced the view that the Fed will pivot and the economy will achieve a soft landing. Performance at the index level and within the market resemble both bear market rallies and the end of Fed hiking cycles, but the 2000 experience illustrates the risk that the market could decline even after hiking stops if the US economy enters a recession. By contrast, if inflation surprises to the upside and requires the Fed to tighten more aggressively than our economists forecast, we would expect equity valuations to compress. Given this macro backdrop, upside seems limited while downside risks loom.

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups