Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #305

Forget everything you learned the last 2 years, what's ahead for venture + startups in the fall

I can’t believe it’s already the last weekend of summer. It went by way too fast and in other ways too slow. Having been in the industry for over 26 years, what this really reflects is a return to normalcy. Charles Hudson from Precursor captured it succinctly.

While I don’t fully subscribe to the dead zone idea as deals have always gotten done over the summer and over holidays, what I can say is that the FOMO and speed at which investments were made in the last two years will not be replicated for quite some time. As we head into the Fall, this reminds me of the advice I shared with my team earlier this month at our partner offsite, “Forget everything you learned the last two years.”

So if that’s the case, what is the Fall going to look like?

Fundraising activity will pick up, lots more meetings to close deals, and expect significant diligence to be done with heightened scrutiny on sales efficiency and burn rates - if you’re raising Series A and beyond, prep your data rooms well in advance. Pre-seed and seed will continue to be strongest areas of activity as a great time to build a company and be heads down on product with minimal distractions.

Later stage rounds will be still be few and far between as many companies still have tons of runway. Only 2 kinds of late stage companies will raise cash - the fastest growing ones where existing investors want to double down and extend the last round price or pay a slight step up or the ones that really need the money in which case they will experience a down round or raise using some type of structured debt product.

Relationships over transactions - due to the FOMO of the last two years, many founders and investors never had the chance to build relationships that would endure through the good and bad times. This will change for the better!

Capital efficiency is back and same with financial discipline meaning growth at all costs with sky high burn rates are out and balanced growth back in vogue…thankfully.

🥩 over sizzle 🥓 - an appreciation for true company builders and those who can execute rather than just tell a story.

Barbell-ing of round sizes at seed - small is beautiful and back but due to so much capital in system, there will still be mega $10M+ seed rounds. That being said, it’s been refreshing to see smaller rounds from experienced founders who could raise lots more come back in vogue.

For those who need to raise 💰, expect significant pressure on valuations as folks had the summer to adjust and reflect. Yes, there will be your outliers who are still growing >150% YoY with incredible operating leverage but not everyone will given credit for that 3 years in advance!

M&A will pick up - from speaking with a number of heads of Corp Dev at large public tech cos during the summer, there has been more inbound activity than ever before…but still the price expectations from Founders have not been realistic. Expect this to change in the fall as we’ll see more tuck-in acquisitions.

More pain to come as I’m not sure how many of us truly understand the energy crisis starting to hit the UK (predictions of 18.6% inflation in next few mos) and the EU - this will impact growth of many later stage and public enterprise companies for sure

Once the system works this out in the next few quarters, we will have a much healthier startup ecosystem and be poised to grow again but don’t expect the 100X Next 12 Month forward multiples any time soon…

And for those ready to start a new company, forget about all of the myths in Silicon Valley around the need to be “first to market” and the idea that many of the best companies were always 🚀 from day one. So many 💎 in this 🧵 from Mitchell, co-founder of Hashicorp one of the leading infrastructure automation cos which just had a killer Q2 with over $113.9M of revenue.

Startups are F8%&ing hard, don’t be afraid of competition

Focus on product, product, product

Developer and infra startups take a LONG time to bake and mature to build the community and groundswell

And as I’ve long witnessed…

As always, 🙏🏼 for reading and please share with friends and colleagues! Let’s get ready to crank it up this Fall!

Scaling Startups

Necessity is the mother of invention

Stay in your swimlane investors…

Food for 🤔

Enterprise Tech

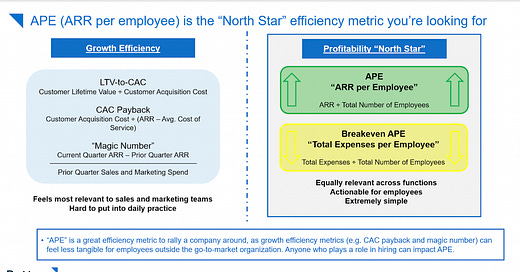

Battery’s State of Cloud Q2 2022 is out and if you’re confused about how to measure yourself against peer cos at similar revenue size, here’s a new one APE 🦍 - ARR per Employee - more here

Developer onboarding and code understanding is still a huge problem to solve and can turbocharge developer productivity, congrats to CodeeSee (a portfolio co) on the launch of CodeSee 2.0, its enterprise product - more from TechCrunch here

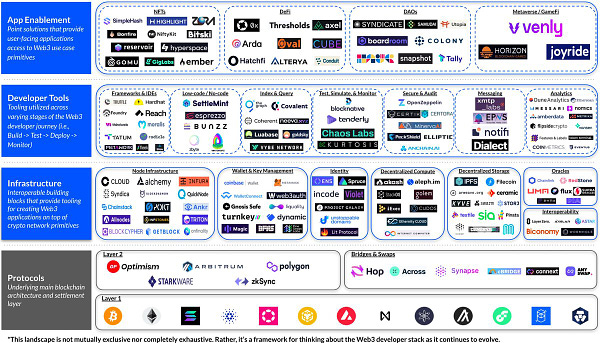

The developer stack for Web3

👇🏼

So what does the future of infra monitoring and observability look like in 2022? Can Datadog get taken down? Prometheus, Chronosphere, Honeycomb and more mentioned…

Future is bright for eBPF - also seeing a number of security cos using it for cloud security...

🤣 ❤️ the huddle is growing -get your 🐧 PFP here and notice mine under VC

Markets

There’s a shitstorm coming when it comes to crazy inflation in Europe due to war in Russia - it will affect us and our markets for sure

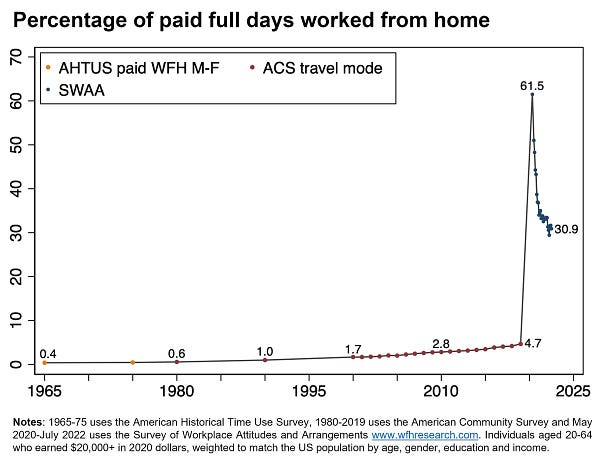

Mega trend…work from home stabilizing…in 🧵 you will see tech averages 2.68 days worked from home…

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups