Discover more from What's Hot 🔥 in Enterprise IT/VC

Happy New Year, and thanks to the many subscribers who joined in the last couple of weeks!

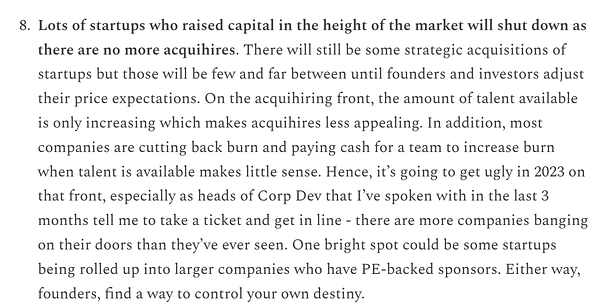

For my first post of 2023, I’d like to issue a Public Service Announcement, one that aligns with one of my predictions for 2023 (read What’s 🔥 322). Don’t count on acquihires this year - see below from Jeff Richards at GGV with some of my commentary and Villi from Two Sigma. Founders, control your own destiny and get laser focused. It’s going to be worse before it gets better back 1/2 of year. Build something of value, and don’t think there is always a soft landing on the horizon. Here’s why 👇🏼

Well said by Villi and Jeff - if someone is going to acquihire you they have to go to bat with their board and show why the technology is going to accelerate its own path to closing more customers and getting more self sufficient. Just acquihiring talent is over - it’s a distraction, takes a ton of time, and there’s plenty of really good people on the market.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

👇🏼

Great framework on community from Camille (ex-Notion)

from one of cofounders of Netflix…founders, keep being different!

Enterprise Tech

💪🏼 Congrats! Yes, Common Paper did this after receiving a seed round led by my firm @boldstartvc and friends at Uncork. Jake and Ben had their reasons, and we agreed - remember it’s not about the ownership today but what could be in the future! Huge opportunity ahead as YC created its standard SAFE and the opportunity to replicate and streamline sales is 🔥.

🤔 worth a read

Aligns with one of my predictions - great comments in 🧵 - from Jyoti, founder of Harness and AppDynamics (sold to Cisco for $3.7B)

IT Prediction for 2023: Companies will seek out ways to dramatically reduce cloud costs. This might sound boring, but the impact is huge.

IT Prediction for 2023: Companies will seek out ways to dramatically reduce cloud costs. This might sound boring, but the impact is huge.Year of Day 2 Cloud Ops: Phase 1 was all about migrating workloads to the cloud, but Phase 2 is about Day 2 Operations; securing, operating, managing and 👆🏼 making the cloud more efficient. As the economy heads towards a recession and cloud growth has been 🤯, its time for companies to finally prioritize FinOps and other efficiency categories in 2023. This covers not only the cost of cloud instances but also consumption spending on data and SaaS applications. My prediction for 2020 was a bit early 😃 but this is the year.

From December 2019 - pre-COVID (boldstart 2019 recap and what’s 🔥 in enterprise 2020)

Rise of FinOps: As cloud and SaaS continue to dominate, the sheer costs of cloud hosting are becoming a bigger and bigger line item under cost of goods sold. While version 1.0 was all about analyzing cloud spend reactively, the next generation will need to be proactive and help companies set

and along those lines…Chronosphere (helps cos monitor and cut cloud bills) raised at a 10% higher valuation from their last round over a year ago at $1.6B - a big valuation given the multiple correction in the last year to you guessed it…help enterprises cut cloud costs!

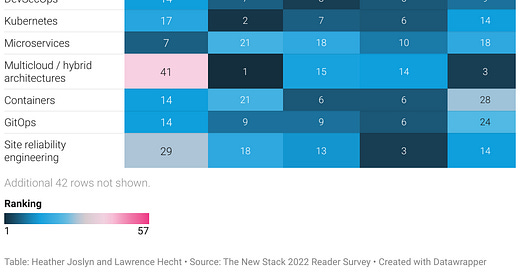

What developers are most interested in versus budget owners like CISOs from The New Stack: API design/mgmt testing high on both lists (check out Zuplo (developer friendly API gateway, a portfolio co) versus huge gap in cloud native ecosystem

State of Israeli cyber security market from YL Ventures - this is one interesting data point as this market has not yet adjusted to the death of mega seed rounds

Our data indicate that the majority of capital that did flow into cybersecurity this year poured directly into one very distinct area: seed rounds of early-stage cybersecurity startups. The average 2022 seed round actually shattered the 2021 record ($7 million), reaching a whopping $9 million. In total, seed funding rose by 65% this year, from $233 million in 2021 to $384 million in 2022.

5 Predictions for WASM in 2023 from Matt Butcher (Fermyon) - also aligns with one of my YE predictions on year of WASM

And one of the biggest Wasm users, Figma, was acquired by Adobe for a staggering $20 billion.

At its core, Wasm is a binary format. Many different languages can compile to the same format, and that binary format can be run on a huge variety of operating systems and architectures. Java and .NET are similar in this way but Wasm has one major difference: The Wasm runtime does not trust the binaries that it executes.

Wasm applications are sequestered in a sandbox and are only allowed to access resources (like files or environment variables) that the user explicitly allows. Wasm has many other desirable properties (such as extraordinary performance), but it is the security model that makes Wasm useful in a wide variety of environments ranging from browsers to edge and IoT and even into the cloud.

If there is a Wasm trend to spot in 2022, it is that Wasm is now enjoying as much (if not more) success beyond the browser than within it. And this trend underlies much of what will come in 2023. With Wasm showing up everywhere from embedded devices to big data centers, 2023 is poised to be the year of Wasm. Here are my five predictions for the 2023 Wasm ecosystem.

OpenAI (ChatGPT creator) rumored to be raising at $29B (WSJ)

Netskope maintaining its last round valuation with a $401M convertible note

The short-term debt financing was led by investment funds managed by Morgan Stanley Tactical Value, with participation from Goldman Sachs Asset Management, Ontario Teachers’ Pension Plan and CPP Investments.

A convertible note is an investment vehicle often used to delay establishing a new valuation for younger companies until a later round of funding or until some other financial milestone is hit, such as an IPO.

Convertible notes are ultimately structured as loans with outstanding balances automatically converted to equity at predesignated points.

Netskope co-founder and CEO Sanjay Beri previously has expressed interest in pursuing an IPO one day. Netskope was last valued at $7.5 billion after raising $300 million in a Series H funding round in 2021.

Markets

What are mutual funds valuing their private investments at (Bloomberg) - these funds are required to mark to market even private investments

Dozens of the companies they bought into are also owned by mutual funds run by the likes of Fidelity and T. Rowe Price that are required to disclose valuations regularly. Mutual funds have been marking down some holdings even more severely than the drop in public markets.

Mining data from thousands of mutual funds over the past year, Bloomberg tracked down their valuations for 46 private companies that also count the five hedge fund firms as investors. Of those, about 70% of the private companies had been marked down by mutual funds through September last year, with an average decline of 35%. Some holdings were slashed by as much as 85%.

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups