Discover more from What's Hot 🔥 in Enterprise IT/VC

What's 🔥 in Enterprise IT/VC #330

On founder led sales for your first 10 customers + importance of desire + attitude

Here’s a reminder for technical founders who may not truly appreciate the importance of selling.

I can’t tell you how many founders I meet in developer tooling or bottoms up sales who truly believe that based on all of the tweets and success stories of PLG cos that no sales is needed - if the product is great, they will buy and swipe a credit card. Sure you do need a great product, but products that sell themselves are rare and mostly for single player app cos like a Calendly for example. And while true in the early days, it’s just a matter of sequencing as you when you layer sales because today Calendly has 158 employees (23% of headcount) categorized as sales and 148 employees (22% of headcount) in engineering. So even for Calendly, sales matters. We dove deep into the importance of selling at one of our bold.camps for developer first founders in “Demystifying PLG” and shared some of our learnings in that post.

Once you get over the stigma that sales is bad and the idea that you’re no longer a PLG company with premium valuations if you actually sell product, it’s time to embrace the art of selling. Yes, you can learn it and master it, but it first starts with this: ATTITUDE 👇🏼

You have to want it badly enough. If someone’s using your product, then yes, you can find a way to get them to pay for it. If you’ve never sold before, here are some simple ways to get started.

Talk to users, prospects, or even some of your bottoms up customers - I know, sounds basic, but I can’t tell you how many dev tooling cos don’t do this, especially since hard to reach some folks because products are initially downloaded.

Find a coach or mentor who knows how to sell.

Record some of your Zooms or use Gong and share with your coach/mentor to get specific feedback.

Invite coach/mentor/consultant to join some of first meetings to listen/learn and maybe participate

Learn a methodology or process like MEDDIC

If you don’t ask, you don’t get - don’t be afraid to ask for money - it’s ok

When it comes to contracts, check out CommonPaper’s standard SaaS + cloud agreements vetted by some of the top enterprise cos to shortcut your process

If it’s a huge deal, make sure to have a good contract lawyer to help with paper that may come from the large co called a MSA or Master Services Agreement

Rinse, repeat, keep learning

Bottom line - get some help but YOU NEED TO OWN IT and you can’t outsource it and not bother with sales or think sales is beneath you. Live it, embrace it, and learn to ❤️ sales. Even as your company scales and you eventually hire a couple of reps, and scale with a VP of Sales and eventually a CRO, you, as a founder, still need to stay close to your customers and continue selling! You might as well start learning now.

As always, 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

Number 1 in Formula 1 on winning culture (h/t Farnam Street)

Wolff is a self-admitted stickler for even the smallest details. He told me that when he first visited the Mercedes team’s factory, in Brackley, England, he walked into the lobby and sat down to wait for the team principal he would come to replace. “On the table were a crumpled Daily Mail newspaper from the week before and two old paper coffee cups,” Wolff recalled. “I went up to the office to meet him, and at the end of our conversation I said, ‘I look forward to working together. But just one thing—that reception area doesn’t say “F1,” and that’s where it needs to start if we want to win.’ He said, ‘It’s the engineering that makes us win,’ and I replied, ‘No, it’s the attitude. It all starts with an attention to detail.’” ... This mindset has contributed to the emergence of an organization that is obsessed with excellence—one that constantly aims to raise its standards and set the benchmark within its sport.

Food for thought when it comes to remote 🧵

Listen to Steve Jobs…

Enterprise Tech

👇🏼💯

Palo Alto Networks earnings presentation summarizes environment 👇🏼 on macro - security still strong, more deal scrutiny, consolidation story and next gen products like Prisma Cloud is big growth opportunity - NGS (next gen security) where all of new products and Prisma Cloud embedded grew 63% YoY to $2.3B in revenue and and upped forecast for next year to 47% growth

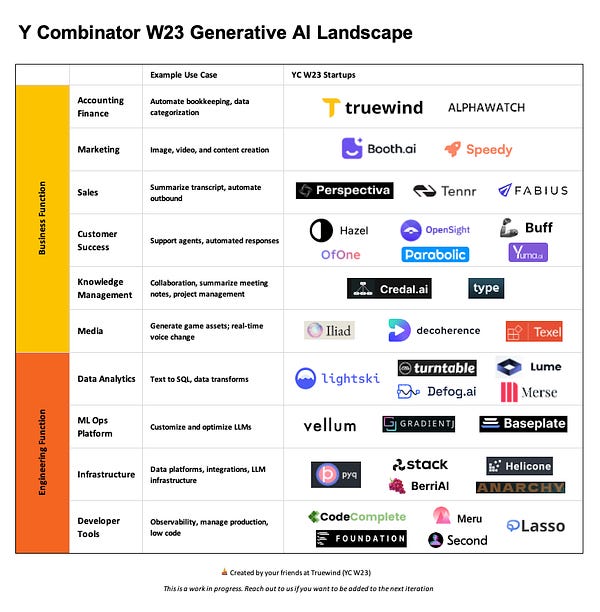

You can always count on YC to capture what’s 🔥 in startup land and this year’s class does not disappoint. I do know of a few already which pivoted into X of Gen AI

Reminder to not rely on one API partner when it comes to AI

Ballsy and big news from Coinbase - a new Ethereum L2, incubated by Coinbase and built on the open-source OP Stack. We have no plans to issue a new network token.

LaunchDarkly the developer feature flagging platform has a new CEO - amazing from Edith to take it from 0 to… - big question is what is second act to go >$100M ARR

8+ years 100 Million ARR 4,000+ customers Trillions of Feature Flags... and now a new CEO for LaunchDarkly! I'm excited for the next chapter and being Exec ChairToday begins an exciting new chapter for LaunchDarkly. We’re welcoming @danrogers100 as CEO as co-founder @edith_h steps into the role of Executive Chairperson. Learn more about what’s next for LaunchDarkly on our blog: https://t.co/XQSF9Nou5n https://t.co/1o4SNA6QNl

8+ years 100 Million ARR 4,000+ customers Trillions of Feature Flags... and now a new CEO for LaunchDarkly! I'm excited for the next chapter and being Exec ChairToday begins an exciting new chapter for LaunchDarkly. We’re welcoming @danrogers100 as CEO as co-founder @edith_h steps into the role of Executive Chairperson. Learn more about what’s next for LaunchDarkly on our blog: https://t.co/XQSF9Nou5n https://t.co/1o4SNA6QNl LaunchDarkly @LaunchDarkly

LaunchDarkly @LaunchDarklyBMC in IT Service Mgmt space and IT Ops (competes with ServiceNow) may file to go public seeking $15B valuation - good for startups as another acquirer in the space (Silicon Angle)

BMC Software is a veteran player in the enterprise technology market, founded way back in 1980 when it was initially focused on selling software for IBM Corp.’s mainframes. Over the years, it has expanded its portfolio to cover other areas, including cloud infrastructure management. It has reportedly built up a customer base that includes about three-quarters of the Forbes Global 50, and it partners with companies such as Dell Technologies Inc., Accenture Plc and Wipro Ltd.

The company is no stranger to the markets either, having been publicly listed until 2013, when it was taken private by a consortium of private equity firms including Bain Capital Private Equity, Golden Gate Capital, GIC, Insight Venture Partners and the activist hedge fund Elliott Management LLC. In 2019, BMC changed hands again when it was acquired by KKR & Co. LP. for a reported price of about $8.5 billion.

Markets

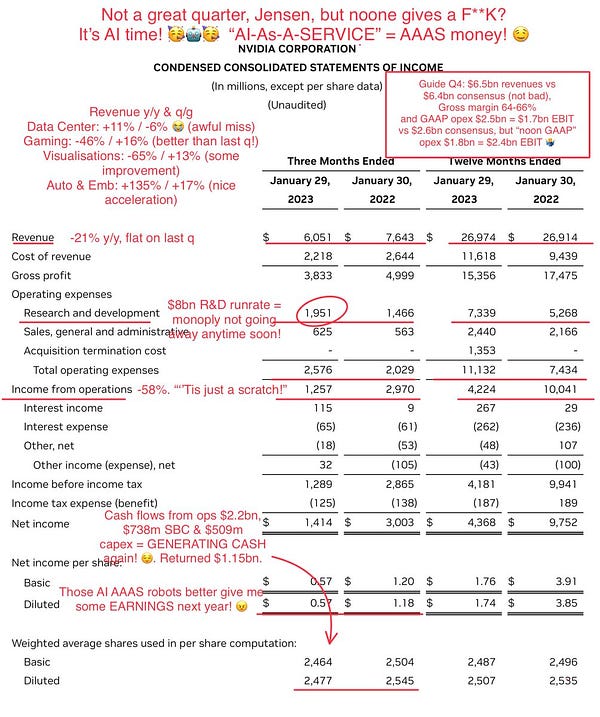

Capitalizing on the AI Boom - Nvidia added $200B of market cap since beginning of year but look at the numbers

What the next couple of quarters will look like 👇🏼

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups