Discover more from What's Hot 🔥 in Enterprise IT/VC

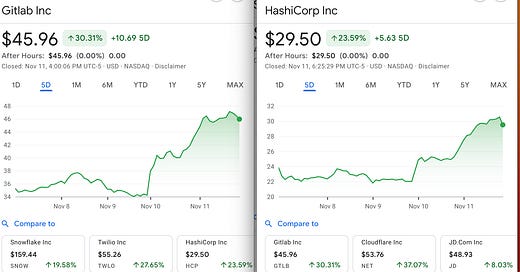

If you’re still not sure what the power of interest rates are on valuations, take a look at these charts as nothing changed other than inflation numbers which were lower this month versus last, indicating that the Fed interest rate increases may be working. IMO, it’s still too early to tell. Gitlab was up over 30% for the week, Hashicorp 23.6%, and Cloudflare over 37%. There is hope 🙏🏼!

Now on to the sad news. What happened with FTX is absolutely terrible for the customers, employees, investors, and industry. What happened to FTX was an epic moment not unlike what happened to Long Term Capital Management which overlevered itself and almost brought down the financial markets ( i highly recommend reading When Genius Failed) or the dot.com bust. Every era of excess needs an epic moment like this to truly recalibrate our thinking.

While many in the industry are in shock and awe at the scale of this meltdown, many also feel somewhat relieved. Why?

During the latest bull market run, the power was in the hands of founders. There was and still is too much 💰, FOMO, and round after round being done before previous money was even touched. The folks who benefitted the most IMO were the best fundraisers, the ones who could dazzle with stories and big visions and yes even visions as big as buying bananas with crypto. Investors desperate to get into the next big thing moved faster, spent less time with founders, and accelerated diligence. Founders also dictated super voting shares, no board of directors, and more. It’s all great when the stock market only goes 📈. A huge part of this is structural as there is too much money overall especially at later stages and speed wins which means mistakes will be made. This is also not new as it happened back in the dot.com days that I lived through and will happen again in the future. That’s the nature of world changing technology and the pursuit of the next big thing.

So why the relief? It’s because value is accruing back to founders with substance, the founders who are more steak 🥩 than sizzle 🥓, the founders who are not using superlatives to change the world but are just building kick ass products and executing. Investors have more time to do proper due diligence, get to know the founders and founders now have time to choose their investors as well. I’m watching it across the portfolio, and it’s so refreshing for me to hear regularly from founders that they are TRULY optimizing for the best partner besides price. In other words if an investor offered the highest price but would not be the best partner for various reason and another offered a price less but still relatively close, many founders now will opt for the longer term partnership - the investors who are more 🥩 than sizzle 🥓 as well. Please read my post from July about moving back to a world of relationship and transactions and why that is good for all of us. This also remains true and only even more important now after events of the past week.

Anyway, this sucks but I am looking forward to continuing to partner with highly technical founders at company formation, those who are more 🥩 than sizzle 🥓 as your time is now! For me, this is the most rewarding part of doing what we do, partnering with underdogs creating new categories and not knowing if it will work but enjoying the ride. These founders will never be the in-demand founders that everyone wants to fund. In fact, these are the founders that will likely get several dozen NOs, NOs because the market doesn’t exist or TAM is not big enough or maybe because folks believe they can’t build it. But IMO this is where the most alpha comes from. Of course, one day you hope that these NOs eventually becomes multiple YESes as the product is built, market evolves, and value is proven. The end result from this mess will be that better, more efficient businesses will be built with less handwavy 👋🏼bullshit being thrown at us from all directions.

As always. 🙏🏼 for reading and please share with your friends and colleagues.

Scaling Startups

VC is a Power Law business!

Small is beautiful

The age of small teams: • @linear has 28 • @NotionHQ had < 40 at $2B • @figma had < 80 at $440M You do not need a large team in pure software businesses to succeedI worked at Facebook when we had 200 employees I’ve never understood why FB needs 20,000 employees. And less so the 70,000 employees Meta has now @elonmusk’s Twitter layoffs are appropriate Unfortunate, but appropriate These businesses just don’t require that many people

The age of small teams: • @linear has 28 • @NotionHQ had < 40 at $2B • @figma had < 80 at $440M You do not need a large team in pure software businesses to succeedI worked at Facebook when we had 200 employees I’ve never understood why FB needs 20,000 employees. And less so the 70,000 employees Meta has now @elonmusk’s Twitter layoffs are appropriate Unfortunate, but appropriate These businesses just don’t require that many people Bobby Goodlatte @rsg

Bobby Goodlatte @rsgMarket sentiment indeed…but why hasn’t it always been the case 🤷🏽♂️

💯

Don’t wait…

Enterprise Tech

Lenny Rachitsky who has a fantastic newsletter and podcast when it comes to product and PLG interviewed Ben Williams is Snyk’s VP Product (Developer Journeys and PLG) to talk about the developer journey and activations

Here’s an excerpt and some of my notes:

How you think about setting activation milestone for new Snyk user?

Activation is indicative of team forming a habit around usage of Snyk - deriving core value, fixing a vulnerability - not finding, not using

Why teams?

Activation and engagements around team since security is a team sport

Enumerate aggregate level activity around fix - sometimes happens off platform but can’t measure at user level

What is in activation process for Snyk?

Set up moments, a ha moments, habit moments - team being activated to fixing vulnerabilities within 30 day of team creation. Reason for choosing - significant correlation downstream with 3 month retention. Teams who fix vulnerabilities with first 30 days are much more likely to be fixing 3 months later

How?

Decision scientist - needed lots of baseline data - once built platform and then had to wait to gather…First needed to identify key personas and use cases, different roles, different users within team based activation journey

What is activation - what are steps to get there? Set up, A ha, and activation…

5 Most Important Tools for PLG

Amplitude, Segment, Fullstory, userinterviews.com, Sprig for in-app surveys and test UX designs and Airtable for growth and product - keep most of experiment and data in there

CNBC’s Inaugural Top 25 Enterprise Tech Startups - 💪🏼 congrats to @boldstartvc portfolio cos Snyk and BigID - also of note, 8 of the top 25 are security cos

"CNBC’s first-ever Top Startups for the Enterprise list highlights startups powering digital transformation, attracting strategic investments and potentially drawing acquisition interest. These are up-and-coming companies built by ambitious, creative, and innovative entrepreneurs who specifically set out to develop the latest technology in business intelligence, IT, cloud, big data, and cybersecurity as companies in all sectors of the economy allocate increasing levels of spending to technology."

How Cloudflare plans to 5x revenue in 5 years to $5B - object storage and zero trust security (Protocol)

A reminder from Villi Iltchev from Two Sigma - Why Gross Margins Matter

More from Kyle Harrison using Twilio as an example of WHY GROSS MARGINS MATTER - trading at 1.5x vs 10-15x for cos like Datadog

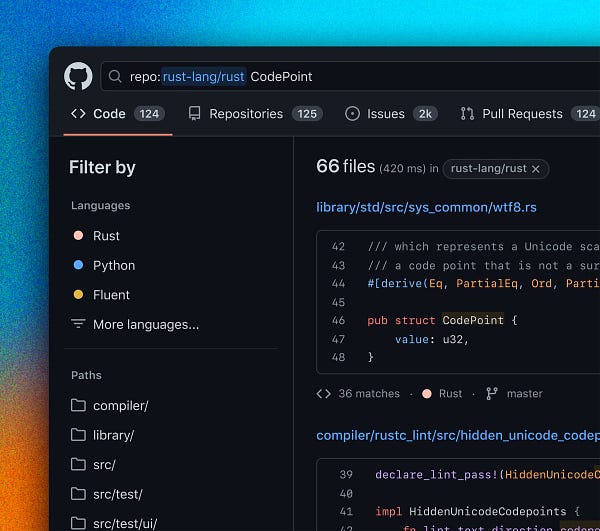

Finally, code search and more from Github - wait till they have API access - will be cool to see what startups build on top

Today, we're excited to launch @github code search - a new way to search and navigate code. We’re introducing a brand new search and code navigation view and they are jam packed with new features. Here are some I’m excited about.... 🧵 1/6

Today, we're excited to launch @github code search - a new way to search and navigate code. We’re introducing a brand new search and code navigation view and they are jam packed with new features. Here are some I’m excited about.... 🧵 1/6

To that end, super excited that M12 launched a new M12 Github fund and its first investment is in CodeSee, code visualization, a boldstart portfolio co

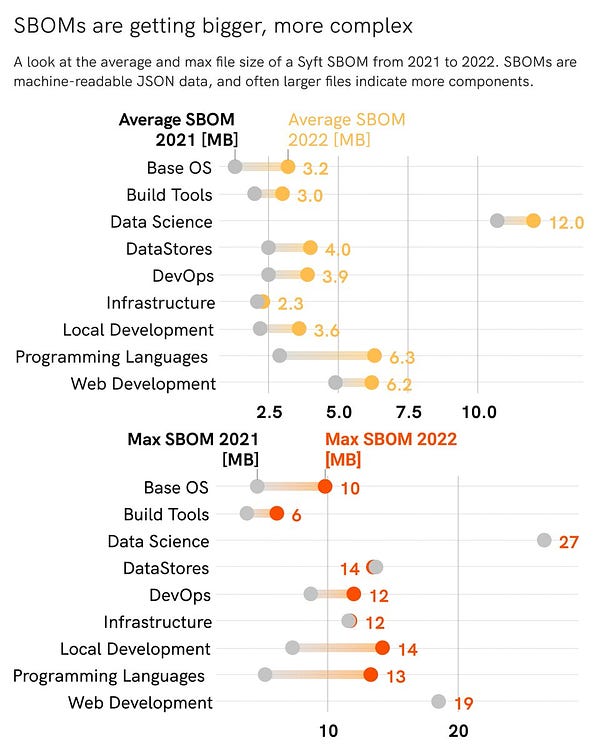

2nd Annual Public Container Report from Slim.ai is out and more security vulnerabilities than ever before with more complex containers = Slim is a must-have so try it out here to analyze, minimize and secure your containers

👇🏼must read on security of public containers - 2nd annual from @SlimDevOps #1: There are more high + critical vulnerabilities than ever across all categories. 60% of top public containers have more vulnerabilities today than we saw a yr ago Component complexity has risen 📈

👇🏼must read on security of public containers - 2nd annual from @SlimDevOps #1: There are more high + critical vulnerabilities than ever across all categories. 60% of top public containers have more vulnerabilities today than we saw a yr ago Component complexity has risen 📈 There are more high and critical vulnerabilities than ever across all categories. 60% of the top public containers had MORE vulns in 2022 than they did in 2021. Is this due to more awareness — or is it just noise? Download the full report for free. https://t.co/cRWL6m8oZz

There are more high and critical vulnerabilities than ever across all categories. 60% of the top public containers had MORE vulns in 2022 than they did in 2021. Is this due to more awareness — or is it just noise? Download the full report for free. https://t.co/cRWL6m8oZz Slim.AI @SlimDevOps

Slim.AI @SlimDevOpsWhy Proof of Reserves needed and auditing for the crypto markets since so unregulated - some companies like Binance took baby steps by publishing its wallet addresses and holdings but it does not show extent of borrowing, etc - here’s more from Nic Carter on POR

Patience and discretion

Markets

🤔

Subscribe to What's Hot 🔥 in Enterprise IT/VC

Ed Sim's (@boldstartvc) weekly readings and notes on enterprise VC, software, and scaling startups

Well written and thanks for the bacon craving